Home Purchase Sentiment - Most Renters are Ready to Buy

It seems we are slowly making our way out of the tunnel. Most renters are showing a willingness to buy once more, what's going on?

Fannie Mae has conducted a national survey for the past few years asking questions to generate a result on their Home Purchase Sentiment Index (HPSI). According to Fannie Mae, the HPSI “reflects consumers’ current views and forward-looking expectations of housing market conditions and complements existing data sources to inform housing-related analysis and decision making.”

Home Purchase Sentiment Low

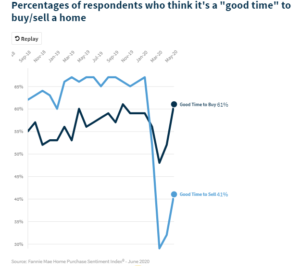

This past April, the Home Purchase Sentiment Index® (HPSI) hit an all-time low at the height of the pandemic lockdown. We have yet to see what the future holds, but for now, the past two months have started to increase and gain a more positive view of homebuying. The Home Purchase Sentiment Index increased 9.0 points in June to 76.5, building further on the prior month’s advance after approaching a survey low in April. According to Fannie Mae, “Four of the six HPSI components increased month over month, with consumers reporting a significantly more positive view of homebuying and home-selling conditions, as well as greater optimism regarding home price appreciation. Year over year, the HPSI is down 15.0 points.”

Home Purchase Sentiment Increase

According to Doug Duncan, Senior Vice President and Chief Economist, “a second month of improvement in June allowed the HPSI to regain some of the sharp losses in optimism observed in March and April.” This home purchase sentiment for renters is especially high; actually, the highest it has been among renters in five years. This information suggests favorable conditions for first-time homebuying. This data is “consistent with the recent rebound in home purchase activity.”

Graph from Fannie Mae National Housing Survey

Supply of Homes For Purchase

Homeowners seem to have taken note of the home purchase activity and the resulting lack of housing supply. They, too, have an increased share in the sentiment of it being a good time to sell a home. According to Doug Duncan, “this activity may cool again in the coming months, depending on the extent to which it can be attributed to consumers having chosen to delay or to accelerate homebuying plans due to the pandemic.” Many survey respondents are worried about the economy. Many respondents cite concerns about job security. This is the key takeaway for most renters and homeowners with taking on a mortgage.

As previously mentioned, many homeowners do believe it is a good time to sell, however, the lack of inventory continues to drive prices up. According to Realtor.com, the national inventory declined by 27.4 percent year-over-year, and inventory in large markets decreased by 26.5 percent. This has driven prices up nationally by 5.1%. Due to low mortgage rates and that limited inventory, buyers do not seem to be arguing as much against the market.

Conclusion

While this is a shorter blog, the information is importnat. We are starting to walk through to the other side of the tunnel. For the most part things are starting to go back to normal. But we have to keep in mind COVID is still a huge issue.

Make sure to check out our other COVID related blogs, we recommend the artical talking about the switch to digital real estate. This will be a change that changes how everyone works in this field.

Comments ()